Fort Worth City Councilmembers did right three weeks ago by temporarily postponing discussions about the battered pension system. The pension that funds the retirements of city employees, including firefighters and police officers, is facing a $1.6 billion shortfall and eventual insolvency. Changes must be made, and they will require painful decisions, such as increasing employee contributions in the future, meaning less take-home pay.

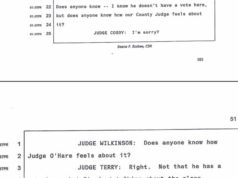

Messing with someone’s money can lead to bad blood. Previous discussions among employees, retirees, and city leaders have been dicey at times, particularly after City Manager David Cooke suggested reducing or cutting some promised cost-of-living raises. Discussing these decisions became more difficult after the recent shooting death of Fort Worth police Officer Garrett Hull.

Part of the reason the pension has become destabilized is the pressure exerted by the Fort Worth Police Officer’s Association and the Fort Worth Professional Firefighters Local 440 over the years. These labor groups are powerful forces in local elections. The police group especially. Resisting their demands and incurring their wrath (in the form of well-financed political opponents) can make it tougher for candidates to become elected or re-elected. Most local politicians have gone along to get along, contributing to the financial mess the system faces.

The labor groups aren’t doing anything wrong or unethical. They are playing the political game, but sometimes your successes can pave the way for an ultimate bellyflop.

The pension fund is paying out about $195 million a year while receiving far less in contributions. Currently, taxpayers contribute about $90 million per year. Employees fork over $32 million. Basic math shows the net result –– a $73 million annual shortfall. Unless something is done, the pension would begin drying up in 25 or 30 years, which could lead to increased taxes, cutbacks in core services, and layoffs of city employees, including police officers and firefighters.

We understand that cops and firefighters want high salaries and good benefits. Without those things, recruits are harder to find and keep. Still, the country and its economy have shifted. Pensions have dwindled in the private sector, while the public job sector –– cities, counties, states, feds –– continue to provide pensions that can sometimes pay someone more in retirement than he or she earned as an employee. But whose fault is that? Not the recipients.

Blame could be placed on pension managers, who sometimes overestimate the potential market returns that are relied upon to fund the pensions. Or pension leaders might have made unwise investment decisions, such as in Dallas, where the Dallas Police and Fire Pension System sank a small fortune into several questionable investments that didn’t provide the anticipated returns.

Traditional pensions, meanwhile, have faded in the private sector as workers have begun funding their own retirements through 401(k)-type accounts. Public pensions keep roaring ahead, with an estimated 22 million Americans –– about 14 percent of the workforce –– working at public jobs. Most of their pensions are financed by local, state, and federal systems, according to a 2017 Forbes article.

Also, people are living longer. The average life expectancy in the United States is about 79, five years more than in 1980. This puts more financial pressure on pension systems.

New policies need to be hammered out, but it seems distasteful to talk about things such as increased life expectancies this close to Hull’s death. City leaders are giving him the respect he deserves for paying the ultimate sacrifice while doing his job.

In Fort Worth, 58 police officers have died in the line of duty dating back to the 1890s. Keeping the city safe is a demanding, dangerous job that requires decent pay and benefits. Overseeing the system requires adhering to the principles of basic math, common sense, and political will. Sometime soon, while still giving respect to first responders for their service, politicians need to make changes, whether that includes boosting employee contributions, reducing cost-of-living increases, or, most preferably, coming up with solutions that don’t require breaking promises made to thousands of former and current employees.

Your article overlooked the group that will be most profoundly affected by any changes in benefits and the group that can least afford it, the retirees. Many of them live below the poverty level and lowering or deleting their Cost of Living raises can make the decision to eat or buy meds a real one if it is not already. Even active employees have stepped up and said that they were willing to pay more, leave the retirees alone. The attitude of some at City Hall that retirees have to help defray the unfounded liability. As a city retiree I can tell you that we did more than our fair share. We went through job freezes, unpaid furloughs, and years without raises. Most of us had no opportunity to earn overtime pay. Yes, this current council inherited the problem but they also inherited the commitment made to retirees that were guaranteed their COLAs.

Your article tells that folks are living longer in retirement. But the statistics on retired police and firefighters is much more grim. We don’t live as long.

Additionally, the FW Police & Fire have been offering for many many years to increase our contributions to the fund. The City has turned us down. Why? Not because the fund didn’t need the increase. The reason is that the City of Fort Worth wants this “crisis “ so that they can make drastic cuts that otherwise would be politically unpalatable.

You’re correct tho. This whole mess is not the retirees fault. And the retirees should not be penalized to fix it.

No. This whole thing is not the fault of Police or Firefighters. The City reduced employee contributions years ago. They should not have. The City has had ample time to address this issue, and to increase employee contributions back to the previous level (this has to go to employees for vote).

Carol Eicher is right. When I went to work for the City, I went without a pay increase for quite some time. In later years there were salary freezes, furlough days, hiring freezes (so if we were short-handed, too bad). Many employees were hired well below private entity wages. They’ve chipped away at insurance benefits – new premiums could cost someone the money they were going to use to pay their water bill. And if a retiree moves away (property taxes are a tad high here), they are punished by having to pay a LOT more out of pocket for medical care.They have broken promises.

They routinely hire upper managers who have retired from other places, paying them six figures; those guys (or women) stay 5 years – just long enough to vest and draw a retirement from the fund to which so many of us have contributed for 20 or 30 years.

Add to that the low morale (David Cooke doesn’t care – why should he? He is guaranteed a 4% pay increase every year. Look it up.)

And taxpayers? I pay taxes. My taxes pay for the streets upon which I drive, the water I drink, the police who risk their lives to protect me, the firefighters who use the water to put out fires or are there if you have an accident, the sewage plant to clean your poopy water, the parks, the community centers…those things don’t run themselves. If I have to pay a few more dollars a year to help keep my fellow retirees in the black, then I’ll do it.

Even though, according to the Political adds, “Texas is Booming” economically, apparently Fort Worth is not. Even though it’s reported quarterly that Sales & Property tax collections are more than expected, Fort Worth is struggling.? Residents are paying their taxes in record numbers, Employees are contributing to the Pension fund and Fort Worth has not paid it’s fair share since 1993 (when it had a 0% unfunded liability), then stopped paying it’s portion completely in 2007. The unfunded liability “crisis?” falls squarely in the hands of the political leaders of Fort Worth. Residents, Employees & Retirees have paid their rent but the City has not paid the mortgage. Police wanted to put more into the Pension Fund, what did Fort Worth do, refused to allow them. Fort Worth leaders are encouraging employees to leave with low wages, reducing benefits to those vested and eliminating benefits to those newly hired and/or not vested, THEN Fort Worth gives the City Manager’s staff a 4% RETROACTIVE raise (at least $14,000 to the City Manager who is in the top 1% of income earnings in Tarrant County) for reducing the Health Insurance Benefit promised to those employees RECRUITED and RETAINED during the roughest economic and deadliest times (Fort Worth was the murder capital in the late 1980’s and early/mid 1990’s). Who resuscitate and propped up Fort Worth during these days – the employees, where were these current City Leaders? It’s infuriating that it took the death of one of our Finest to put a (temporary?) hold on reducing/eliminating EARNED benefits further. SHAME.

When giving the numbers on how much the retirement fund pays out every year compared to what it takes in you forgot to add in how much investment interest the fund takes in every year. You left that number out of your “Basic Math” adding.

The fund is increasing every year.

I spent most of my working years as an employee of the City of Fort Worth. I remember the years that the City budget was great enough that we were in the black and any extra monies went to improve our City parks. I also remember the very lean years of furloughs (we voted to take those unpaid days to help save the jobs of our co-workers and the City still laid them off), the hiring freezes (and we were already expected to maintain the same level of customer service with much less staff) and minimal or no raises (my last 8 years with the City I got no raises (I assume because I had worked there too long and my knowledge and experience were worthless – at least that’s how they made those of us with seniority feel). The taxpayers got reduced City services and it was the employees who kept having to apologize (and get blamed for) the lack of those services). I feel that many of the tenured employees were being pressured to leave so they could hire employees in at a lesser rate of pay and then give them few benefits. It’s sad that the employees and the retirees – the people who really make/made this City run are looked upon as a liability. I agree with Alison Letnes. Read the stories about all of the sales tax revenue and the job availability, the growth of our City, etc. and it makes you wonder why our City leaders can’t seem to balance a budget, give proper City services and take care of their employees and retirees. I retired when I did because I was counting on my COLA. Now the City wants to give us Diet COLA and that leaves a bad taste in my mouth. Maybe a fresh set of eyes in our City leadership has become a necessity.

I agree with everyone else. I work very hard when it was very hot and cold. Sometimes long hours also when others people’s didn’t work. I had a lot of straight time that should been over time. I was force out on 25 years because they had someone of there friend that needed a job so they let me go. They started the new person off at 5 dollars less than I was and he didn’t know nothing.

Please keep in mind municipal employees do not get social security. Even if you go on to another career in your ‘retirement’, city employees do not get it. The fire/ police and general employees have offered to equally share this shortfall and split the 10.5% down the middle. Look up David Cook’s pay and car allowance and moving expenditures and yes he will vest in 5 years and drain the city more than any employee could. The fire/ police and general employees have had health insurance costs skyrocket over the last 20 years… the City mismanaged many financial deals without consequence. Anyone else would be fired in the private sector. I’m also embarrassed at the millions we spend on art/ if you call it that/ while allowing self insured city to increase healthcare costs to double and triple every year. Most can not afford to go to a doctor at $100+/ trip and get insulin at hundred per month. There’s so much more to this than reported here. Hang on Fort Worth, pretty soon hiring will be more of an issue than it is now. Who will fight your fires? Arrest your bad guys? Keep our water clean? Repair your streets and busted water pipes? Watch this video:

https://www.star-telegram.com/news/local/community/fort-worth/article218131845.html