Imagine this: It’s July 4, a national holiday, a time for family, fun, and relaxation, and Static colleague Sarah Perry is slaving away as a waitress at a local restaurant to supplement her nearly nonexistent income as a Weekly intern. In comes a group of five, and they run her ass ragged for almost two hours, ordering special drinks and custom entreés, sending things back to the kitchen and to the bar, and making it difficult for her to properly serve her other customers. And then this bunch of cheapskates get up and leave a $2 tip.

Now that’s gall.

Which brings us to Lloyd Blankfein, CEO of Goldman Sachs, a holding company that specializes in investment banking and other financial services. If you drove past the Tarrant County Courthouse on Tuesday afternoon, you might have noticed Blankfein’s image bobbing up and down on posters wielded by angry protesters. Seems Blankfein is all about financial aid (and gall) when his palms are out – his company took 10 billion in taxpayer bailout bucks last year (when his annual compensation was about $68 million annually). But when President Barack Obama later encouraged lenders to give some little folks a break if they were behind on their mortgage payments, Blankfein wasn’t interested. (Bet he’s a lousy tipper, too.)

Arlington resident Celina Gallegos financed her home through Litton Loans several years ago. Even though she was working two jobs to support her 14-year-old son, Gallegos had gotten behind on her $1,100-a-month mortgage and asked Litton for help. She wanted to decrease her mortgage payment by extending her loan. Litton, a subsidiary of Goldman Sachs, said, “Uh … not hardly.”

Gallegos contacted the Association of Community Organizations for Reform Now (ACORN), a grassroots nonprofit organization that offers free assistance for people in or near foreclosure. ACORN called Litton Loans to try to work out a deal for Gallegos. No deal. Gallegos was scheduled for eviction.

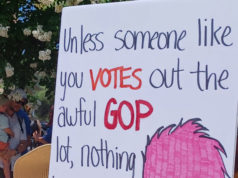

So about 20 people showed up in downtown Fort Worth on Tuesday intending to protest the auction of her home and to crucify Blankfein, Goldman Sachs, and Litton Loans. But on the day of the protest, just prior to the scheduled forced sale of her house, Gallegos got a phone call. Litton Loans miraculously gave her 30 more days to catch up on payments before her home goes to auction.

The protest on Gallegos’ behalf is one of dozens like it being held across the country by ACORN in an effort to help beleaguered homeowners and to call attention to giant lenders’ failings.

Goldman Sachs later repaid the money it borrowed from taxpayers. Gallegos expects to repay her loan as well, but she needs a little help now, kind of like Blankfein did not long ago.