Eren Reddick and his dad, Jim, meet just about every Saturday afternoon to shoot the breeze over a few beers. But they don’t do it in some local bar or at their homes. They do it on Fort Worth’s Near South Side at the Rahr & Sons Brewery, with about 600 others.

If you think that drinkin g beer with strangers in a warehouse doesn’t sound like a family event, you might be wrong. The crowds at the Saturday Rahr tastings and beer tours are family-friendly. Parents push around kids in strollers, grandparents and their kids and their grandchildren sit at picnic tables listening to music and eating barbecue. And amid this mass of humanity, the beer is flowing freely.

g beer with strangers in a warehouse doesn’t sound like a family event, you might be wrong. The crowds at the Saturday Rahr tastings and beer tours are family-friendly. Parents push around kids in strollers, grandparents and their kids and their grandchildren sit at picnic tables listening to music and eating barbecue. And amid this mass of humanity, the beer is flowing freely.

In fact, the entire crowd is a sort of extended family. Many people make this a weekly ritual, drawn in part by a common love of award-winning beers that actually have distinctive flavor. So college frat boys are hanging out with guys old enough to be their grandfathers, white-collar marketing reps with truck drivers, the tattooed and pierced with soccer moms.

The Reddicks are sitting with some friends, 70-year-old Butch Ritchey and 64-year-old Dan Hutchinson. Jim Reddick jokes that they come to Rahr because of the “great free beer … well, almost free beer.”

The beer is not free, but Rahr cannot sell it to these consumers. One of the many oddities of Texas alcohol laws is a clause that prevents brewers from selling their products at the site where they make them. Rahr gets around the law by selling a glass to each adult customer. With the glass comes three tokens for fill-ups, which technically are “tasting samples” as part of the brewery tour. If you bring your own glass, then you buy the tokens from a nonprofit, on this day the Big Brothers and Big Sisters of North Texas.

If all this seems confusing, then consider what the Texas Legislature is wrestling with down in Austin this spring. Small “craft” brewers like Rahr & Sons, who want to be able to sell small amounts of take-home beer to folks who visit their breweries, are being opposed by big distributors. Small breweries outside Texas can market their beer here – but the local companies can’t.

Rahr and the other seven small breweries in the state say current laws make it nearly impossible to compete with the big boys like Miller and Anheuser-Busch, not to mention the craft beers from other states. They aren’t asking to have retail convenience stores on their property, just the right to move some cases when the big crowds show up for tours. (Rahr beers are sold at liquor and grocery stores and on tap at local bars, almost all within Tarrant County.)

But it’s not the big beer companies like Budweiser, which brews down in Houston, or Miller in Fort Worth, that are working hard against the beer-at-the-brewery sales. It’s the companies that distribute the Bud and Miller.

“I would probably take some home if they were able to sell it here,” said Eren Reddick. “The Rahr beers are great but very hard to find sometimes. It just seems this state would like to encourage local businesses like this to be able to grow and compete, to create jobs and get the tax money from the purchases.

“A local brewer like Rahr is very important for a community,” he said. “They do so much work within the community, from their help with nonprofits to creating local jobs. And selling some beer from here on Saturday wouldn’t affect the sales of Budweiser.”

Budweiser advertises its Bud Light as having “drinkability.” That does not mean their beer has great taste or a distinctive aroma and palate-worthiness. What they are telling customers is that their beer is like slightly flavored water with a little alcohol. Very little flavor of malted grain and hops survives, since the brew is over-filtered to remove most beer taste, and the low alcohol content means you can drink a lot of it without getting a big buzz.

Craft brewers like Rahr take a different approach. Their products are not designed to be chugged in large quantities. Water is not added after fermentation, so the alcohol level is about double that of the big brewers’ drinks. Brewers mix malted grains and hops the way a fine chef would go about creating new dishes. Ingredients are experimented with and tested, and different flavors are produced in different seasons.

Hence you get a wide variety of beers from each brewery. Rahr’s Ugly Pug is a schwarzbier, or German black lager, very filling. Their Buffalo Butt is a smooth, medium-bodied amber lager, with a hint of caramel. Blind Salamander pale ale is cloudy with a strong malt taste. The Winter Warmer has the flavor of a strong British dark ale.

Rahr’s successes are particularly notable given that the brand is only five years old. In other ways, though, its pedigree goes back more than a century and a half, to two centers of brewing quality, Wisconsin and Germany.

Fritz Rahr, now 42, grew up in Wisconsin, where he worked summers for his family’s business, Rahr Malting Co., and made his own brews at home from the time he was 13. The malting company was founded by his great-great grandfather, Wilhelm Rahr, after he immigrated to America in 1847 from Germany. But instead of staying in the family business, Fritz came to Texas, graduated from Texas Christian University, and went to work in sales and marketing for the railroad industry. By 2004, though, he was itching to get back into the brewery business. That year he founded Rahr Brewing in an old warehouse near South Main Street and Rosedale Avenue.

Since then, the brewery has racked up some fairly significant awards. Four times, Rahr has won the best in class at the United States Beer Tasting Championships. In 2008, Rahr’s Bucking Bock won a bronze medal at the World Beer Cup. This year, Iron Thistle, a fairly heavy scotch-style ale, was named a National Grand Champion at the United States Beer Tasting Championships. Just last week the company was named Best Craft Brewery Down South by thefullpint.com, a national beer news web site.

During that time, several brewmasters have come and gone. The latest, J.B. Flowers, has been with the company since December 2007. Despite the turnover, the awards keep coming, and the beer quality has never been compromised.

It’s all about experimentation. Grains and hops are mixed and brewed in small batches (50 to 100 gallons), local beer drinkers are invited to taste the results, and various new approaches are tried with traditional ales and lagers, including varying the beer’s time in the fermentation tank from four to 10 weeks.

“Beer has been made for more than 5,000 years, and it has all been done before,” said Flowers, 46, who has been a home brewer for 15 years and took brewing classes at the University of California at Davis. “We study recipes and style guidelines. But that is just the starting point. My specialty is Scottish ale, and the reason we won that award for Iron Thistle is that I took some Scottish ale basics and added a personal touch to them.”

Flowers said that the craft brewers are usually willing to compare notes. “The big brewers keep all their information secret, but us smaller brewers are pretty good about sharing what works and what doesn’t,” he said.

Jeff Holt, a Fredericksburg resident who follows the Texas beer industry on his web site, texasbreweries.com, said Rahr is gaining a reputation in Texas as “one of the best brewers out there,” making its mark across the suds spectrum, from ales to lagers, heavy and light.

In other ways, though, the process has been a tough one.

“I would definitely buy some of Rahr’s beer if I could get it down here, but the way the laws in Texas work and the business model for breweries in this state make it nearly impossible,” Holt said.

Rahr managing partner Tony Formby, 56, recalled a recent meeting with the sales reps for the Coors Distributing Co. of Fort Worth. The distributor is not owned by the Colorado brewer but has exclusive rights to sell Coors beers to retailers in Tarrant and Johnson counties. They also distribute many others: Sam Adams, Tecate, Molson, Colt 45 malt liquor, and the Rahr line of 10 beers.

“It was about 7 in the morning, and all the reps from the brewers were to make a presentation,” Formby said. “I told them how we had just won a bronze medal at the World Beer Cup, which is kind of the Olympics of beer competition. I also told them about how our Iron Thistle beer just was named a national grand champion at the United States Beer Tasting Championships. I was trying to tell them that these awards were very important and that maybe they could use that to get more retail shelf space for us and maybe some more taps in bars.”

After Formby spoke, the reps from the Coors brewery had their turn. “The Coors people were these beautiful young women talking to guys who drive trucks and deliver beer,” Formby said with a laugh. “The distributor guys were told that Coors would track Coors’ sales on their routes and then give a fully paid trip to Las Vegas for the top eight salesmen and their wives. Then they had a raffle for five George Foreman grills and 12 packages of Omaha steaks.”

“You think those beer distributors gave a shit about Rahr winning a bronze medal in a worldwide competition?” Formby asked. “I think the trip to Vegas was maybe a little more important.”

Formby knows what he is up against, and he doesn’t want to take the power of the distributors out of the loop. But it is very tough to start a brewery in Texas and make it successful.

After Prohibition ended nearly 80 years ago, laws were enacted in Texas to prohibit vertical monopolies in the alcohol industry. The “three-tier” system kept the manufacturers (brewers and distillers), the distributors (wholesalers), and the retailers (bars and package stores) completely separate. But over time, the middlemen became the power brokers, especially in the beer section of the liquor business.

Exclusive territories have been established, with distributors lining up the rights to represent big and small beer companies. Brewers who want to change those distribution agreements face serious penalties under Texas franchise laws. “We are joined at the hip with the distributors in many respects,” Formby said.

“The laws in Texas are very strict when it comes to breweries,” said Paul Gatza, director of the Brewers Association, a national craft brewer trade organization based in Colorado. “Texas has a reputation of wholesalers having too much power. In most states, small brewers can sell their product [directly] to the public, have a restaurant and bar on their site, and make some money from tourism. You would think Texas might like to loosen these laws and get some needed tax revenue.”

Some of the laws are downright nutty. For example, Rahr cannot post on its web site or even tell a person who calls the office which bars and stores carry their product. Bars cannot advertise that they carry any specific beer or that they offer a special price. Bars can advertise that they are selling “domestic longnecks” during happy hour for $2 but cannot say they have Ugly Pug on tap.

Rahr and the other small brewers can advertise their product in general terms, but the cost of mass-media marketing is too high. On the other hand, the big brewers have millions to spend on TV ads during the Super Bowl.

A change to allow on-site beer sales is a “matter of fairness,” Formby said. In 2005, Texas winemakers fought for the right to sell on their premises and won. The difference between the beer and wine businesses is that the winemakers had the backing of the agricultural lobby because grapes used to make the wine were grown in Texas. No such luck for the beverage made from malted grains and hops.

Formby contends that distributors would benefit from small brewers being able to sell limited amounts on site. He said if he sold $8,000 worth of beer each month at these Saturday tastings, he could add another sales rep to market the product outside of Tarrant County.

“People would take some home, share it with friends or family members, and the brand would get to be more well known,” he said. But that shouldn’t hurt sales of Rahr for distributors or retailers, he said. “People would look to buy it in stores, because they wouldn’t drive all the way here to buy beer if it was closer to home.

“What has really changed is the number of beers coming in from out of state,” Formby said. “These brewers operate in states that allow them to sell directly to the public and to advertise in ways not allowed here. So they grow and look to export to this market.”

For example, Fort Worth distributor Ben E. Keith recently bought out a San Antonio distributor that had the Texas rights to sell 60 craft beers like Redhook Ale and Sierra Nevada – but only two Texas labels. Coors Distributing holds the local rights to wholesale Rahr, accounting for most of the Fort Worth brewer’s sales. And because Ben E. Keith does not have the rights to Rahr’s biggest market – Tarrant County – they are not interested in taking the product to the markets they have lined up for the other craft beers, according to Formby.

“The way it works now is it takes four or five years to get a brewery going, and even then it is tough to make a profit,” Formby said. “It takes that long to get a distributor to take your product, and then you have to fight just to get some shelf space. You can’t market your product yourself in many ways, and the distributor isn’t interested in pushing it when they are selling the Millers and the Buds. So we get stuck in a place that is very hard to get out of.”

Formby knows all about profit and the lack thereof. His investment in Rahr helped keep the company alive.

He joined the business in January 2008. A native of Vancouver, Canada, he had never been much of a beer connoisseur. “When I was younger, it was Labatt’s or Molson or whatever they were passing out at the parties,” he said.

Formby made a lot of money in the 1980s and 1990s in the high-tech biz, first with the development of computerized touch screens used in restaurant and bars and then with LED flat-panel screens for computers.

He moved his family to Texas in the mid-1990s because he traveled a lot for business and Dallas is a centrally located transportation hub. They started visiting Fort Worth, liked it, and eventually moved here. He sold his businesses for a healthy profit and partially retired. But Formby kept his eye out for investments in entrepreneurs with new ideas. One was a company that developed a process for shooting light through carved glass panels that could be used for advertising. Fritz Rahr purchased some of the glass panels, and he invited Formby to come to the Saturday tours.

He moved his family to Texas in the mid-1990s because he traveled a lot for business and Dallas is a centrally located transportation hub. They started visiting Fort Worth, liked it, and eventually moved here. He sold his businesses for a healthy profit and partially retired. But Formby kept his eye out for investments in entrepreneurs with new ideas. One was a company that developed a process for shooting light through carved glass panels that could be used for advertising. Fritz Rahr purchased some of the glass panels, and he invited Formby to come to the Saturday tours.

The quality of the product overwhelmed the transplanted Canadian. “I could see that these were beers that could sell very well, and being the only small brewery in such a big market as Dallas-Fort Worth, I thought it might make it,” he said.

Rahr told Formby around Christmas of 2007 that he would have to close the brewery soon if he couldn’t find investors. Formby weighed his options and decided to invest. (He won’t say how much he put in, but he and Fritz Rahr each own about 40 percent of the business.)

Formby’s investment helped keep the company going, but Fritz Rahr still needed income, and the beer business wasn’t providing it. Two years ago, he moved to St. Croix in the U.S. Virgin Islands to run a shipping facility for a petroleum company. He kept his ownership share but left the running of the brewery to Formby. Rahr & Sons has expanded under Formby; production has increased from about 1,500 barrels per year (one barrel equals 31 gallons or almost 14 cases) to 3,400.

The company employs three brewers and one sales rep. Until recently, the beer- bottling line was staffed by volunteers who did the work for some free beer and food. The company sold $900,000 worth of beer last year and eked out a small profit – its first. Formby has yet to get a paycheck.

“We live in a microbrewery desert in some respects,” said Jeff Holt. “I can’t imagine how difficult and frustrating it must be for these brewers to know that even if they have a great product, getting it on the shelf is almost impossible.”

It isn’t that Texas isn’t a good beer market. The Lone Star State is second only to California in beer consumption in this country. Texans drink more than 6 billion 12-ounce beers annually, which works out to 16 cases for every person over the age of 21.

But beer’s popularity here has not pumped up sales of the craft brewers as it has in other states. California has about 150 small breweries, and Texas has eight. When population is considered, Texas ranks 47th in craft breweries.

According to the Brewers Association, sales of the big beers (Miller, Coors, and Anheuser-Busch) have been flat – no pun intended – in the past few years. However, in 2008, beer volume produced by craft brewers across the country rose 5.8 percent, and revenue went up by 10.5 percent.

Breweries that produce less than 75,000 barrels per year like Rahr can distribute their product themselves, but it is costly and the distributors have a lot of control of the shelf space and the taps. In other states, the small breweries get around the distribution problem to some extent by selling on site, providing another avenue for introducing their beers to potential customers.

“It is a catch-22 situation in many respects,” said Gatza. “You can’t get a distributor until you get a track record, but you can’t get a track record until you get a distributor.”

Some observers contend that the strict three-tier system is outdated. “If you open this up to more competition, the public would benefit greatly with the market determining price and not the distributors, who have pretty much a monopoly on how alcohol is sold in Texas,” said Austin attorney Howard Wolf. In 2007, he served on the sunset review committee that looked into the operations of the Texas Alcoholic Beverage Commission.

He compared the situation to the pharmaceutical industry. “Drug companies use wholesalers to sell some of their products, and they sell direct with some of their other products,” he said. Craft brewers, Wolf said, “should be able to bind together to sell their product, they should be able to sell it from their breweries, and they should be able to advertise and market in whatever way they want.”

Officials of the big distributors in North Texas – Coors Distributing, Andrews Distributing, and the Ben E. Keith Co. – would not comment for this story. According to several sources, however, all three vigorously oppose allowing the small brewers to sell their product on site. Their lobbyist, Mike McKinney of the Wholesale Beer Distributors of Texas, said as much at a public hearing in Austin two weeks ago.

Another beer distributor association, the Beer Alliance of Texas, which represents the big distributors in Houston and the southern part of the state, has come out in favor of changing the law. After all, the legislation now being considered would not allow breweries to sell beer – they could only sell tours.

Fort Worth State Rep. Lon Burnam filed a “parity bill” earlier this year that would allow breweries to sell bottles and kegs from their sites, to a maximum of 1,000 barrels per year. Fort Worth’s newly elected state senator, Wendy Davis, filed a similar bill.

“The distributors are extremely powerful,” Burnam said, “and it is tough for them [small breweries] to get shelf space in the traditional way we have set up this market. We need to help local businesses in this state. We consume a lot of beer in this state, but not much that is of good quality, and certainly not much locally made.”

But lobbyists for the big distributors effectively sank both bills, according to several sources, by making sure they couldn’t even get hearings in their respective committees.

Rep. Jessica Farrar of Houston came up with a compromise. Farrar’s district includes the Saint Arnold Brewery, sort of the Houston equivalent of Rahr & Sons. Working with Rick Donley, president of the Beer Alliance of Texas, Farrar wrote a proposal that would loosen restrictions on the small brewers without upending the three-tier system.

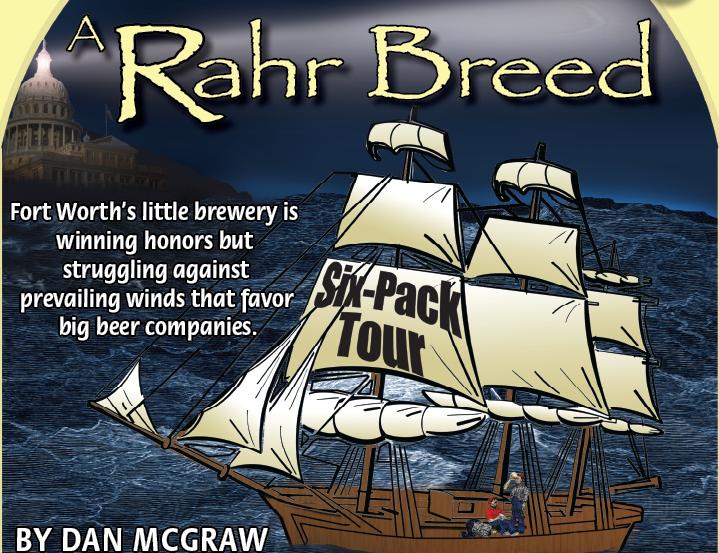

Under Farrar’s bill, breweries that make less than 250,000 barrels a year could sell different types of tours: A regular tour would include no beer at the end. Pay a little more, and you get a “six-pack tour,” with beer provided after the tour. There could also be a one-case tour or a two-case tour.

“We are a strong supporter of the three-tier system, and we thought this was a reasonable compromise,” Donley said. “The legislation does not authorize direct sales to consumers. It allows them to charge for tours and then give the beer away. This will help the microbreweries to get their message out.”

The small brewers signed on to the compromise. “The language is a little different, but the new bill accomplishes the same thing,” said Brock Wagner, president of the Saint Arnold Brewery. “This is a right brewers have in most states. Allowing the six-pack-tour visitors to come through will improve the financial stability of breweries, especially when they are starting out. Those first few years are very tough. This small adjustment would benefit everybody.”

“A lot of the wholesalers are fixated on the zero-sum game,” Wagner said. “They figure that if [consumers] get a six-pack at our brewery, they aren’t going to buy a six-pack at the store. But these are sales that never would have occurred otherwise. People aren’t going to drive to the breweries when they can get it at a store close to home. But this will make the craft brewers stronger, and the distributors will see an increase in their sales through this kind of marketing.”

Back at Rahr & Sons, it is the Saturday before St. Patrick’s Day, and the brewery is full once again. There’s no green beer here, just plenty of lagers and ales in the colors of dark brown and blonde and red.

Jason Van Gilder, 28, an assistant brewer with the company, is sitting on the loading dock with his girlfriend, Chelsea Rickert, in a porch swing. The loading dock is the smoking area for the tour drinkers, and it is packed with people puffing and sipping.

“The big brewers are just mass factories, and the beer pours off the assembly line, always the same, and always without any distinction,” Van Gilder said. A home brewer for about eight years, he decided to shed his tech job at Texas Instruments and follow his passion. Rahr hired him full time last year. “I had a grasp of brewing basics, but doing it like this in these batches is a different world,” he said. “But we like to experiment and love to have some seasonal products that are available for just a short time.

“What we are doing is getting back to Americana,” he said. “We used to have a lot of beer that was locally made, very fresh and with distinctive flavors, not filtered and bland. We love regional cuisine and local food, but for some reason beer in Texas has not been a part of that.”

With its large numbers of German immigrants in the 1800s, Texas was once a lively beer state. There were 77 breweries in the state in 1870. But Anheuser-Busch of St. Louis came in the late 1800s, and the company advertised heavily and bought up icehouses. By 1920, when Prohibition arrived, there were just 18 breweries left in Texas.

After Prohibition, the small breweries continued to disappear, as the big brewers gathered up market share. But in the 1990s, a beer renaissance began in many parts of the country. Suds fans wanted a different product and were willing to pay more for their beer. There are now about 500 microbreweries operating in the United States, according to the Brewers Association, most of them in states where laws make it easier for companies just starting out.

As a bagpipe band marches through the brewery, people are lined up 20 deep at the taps. Formby leads a reporter up to the bar and quips that “One of the benefits of being the managing partner of Rahr & Sons is that I get to cut in line.”

Then he pours some of his products: a refreshing Irish red ale, the dark Ugly Pug, the tasty Iron Thistle, and the cloudy Blind Salamander. Each distinctive, each displaying a different sort of drinkability.

“You can see all these people here, and you can see how they all really like this kind of beer,” Formby said. If Rahr & Sons can get its products out to the people, he said, he believes the company can “make Fort Worth known as one of the top beer cities in the state.” And maybe make him, finally, a return on his investment.

Then he smiles and pour another one, this time a blonde lager. “You’ll really like this one,” he said.